An auspicious group of like-minded partners will deploy an open protocol for decentralized working capital and MSME financial solutions across Africa.

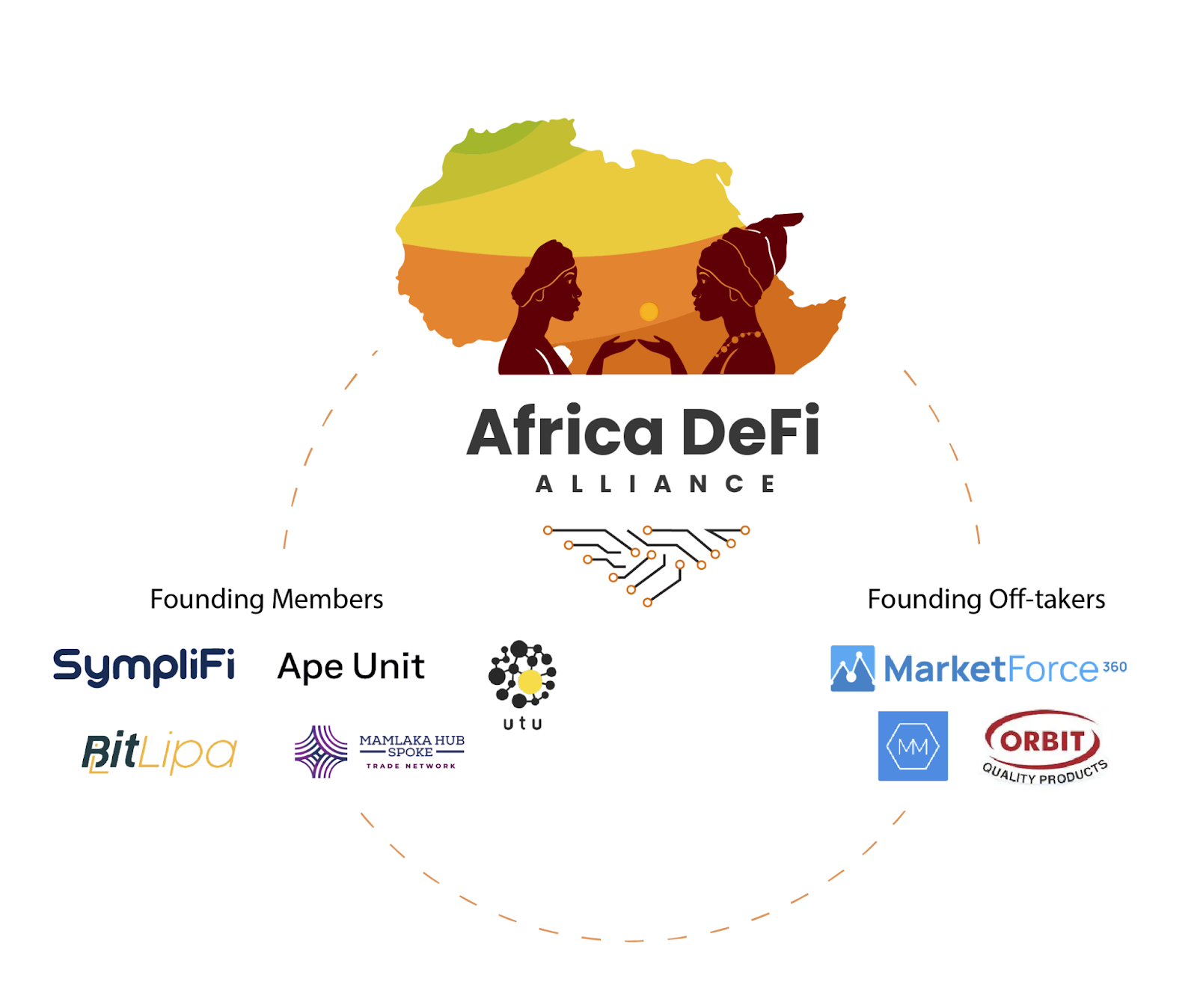

Founding members Ape Unit, BitLipa, Mamlaka, SympliFi, and UTU, alongside Founding Off-Takers MarketForce, MaraMoja, and Orbit Products Africa, have come together to launch the Africa DeFi Alliance with the audacious goal of moving $100B in working capital into the continents’ MSMEs at transformational rates.

What is the Africa DeFi Alliance and who is involved?

The goals of the Africa DeFi Alliance are to provide transformative, decentralized financial solutions for MSMEs in Africa, and to be the de facto home of DeFi applications serving real-world use cases across the continent.

Decentralized finance, better creditworthiness assessments, and trust mechanisms that leverage relationships and data can open up financial resources to businesses who historically have not had sufficient access to affordable funding. The creation of the Africa DeFi Alliance will enable the seamless sourcing of capital from decentralized liquidity pools to help African entrepreneurs access working capital at transformative rates to run and grow their businesses.

The Africa DeFi Alliance will enable real world DeFi use cases by building an open protocol to connect liquidity to micro loans with built in conversion, on/off-ramping, and scoring capabilities. The protocol seeks to bridge the gap between low savings yields in developed markets and the high cost of borrowing in emerging markets.

Founding partners UTU, SympliFi, Mamlaka, Ape Unit, & BitLipa will all play critical roles and provide necessary infrastructure to the Alliance:

- Ape Unit will serve as the enabling technical partner to build the underlying protocol and supporting other partners’ technical needs

- BitLipa will provide seamless crypto on-/off-ramping into local currencies

- Mamlaka and SympliFi will launch and market liquidity pools and provide lending facilitation

- UTU will provide its trust mechanisms, data ingestion/analysis, and scoring of borrowers

Founding Off-takers MaraMoja, MarketForce, and Orbit Products Africa will be among the first liquidity pools that the Alliance implements to prove out the value proposition across key lending use cases such as Earned Wage Acces, B2B Buy Now Pay Later, and Supply Chain Finance.

Early pilot results with MaraMoja have been extremely positive with 100% loan uptake by MaraMoja drivers and 100% repayment across more than 270 loans worth $10,000, an at lending rates that are 5-10x better than what was otherwise available to them. MaraMoja has a network of more than 40,000 transportation workers across Kenya

The Alliance, which has formed as a DAO, seeks to onboard new like-minded members in these areas:

- On/Off Ramps

- Off-TakersAfrican Businesses & networks of MSMSEs that need working capital

- Liquidity Providers

- Liquidity Pool Operators/Marketers

- Identity Mechanisms

- Trust/Scoring Mechanisms

- Other Service providers

- Chains on which to build the full protocol

- Financial supporters

Forming this alliance means delivering on our core belief: bring the potential of web3 into the palms of those who make the most out of it. As a blockchain enabler we always strive to make decentralization usable for everyone and with this partnership we strengthen our promise: Set the stage for many high-impact use-cases that empower people and foster change.

-Yannick Musafiri, Lead Blockchain Engineer of Ape Unit

We are excited to participate in pioneering access to much needed affordable financing for MSMEs across Africa. De-Fi is opening up an array of opportunities for micro entrepreneurs around the world to more efficiently access financial services solutions that have not been readily accessible.

-Apollo Eric, Co-Founder and CEO of BitLipa

Africa’s development has been supported by cooperative models that have transformed poverty-ridden communities into vibrant economies. The Africa DeFi Alliance is tapping on the same mechanisms through the cooperative membership of different stakeholders to contribute significantly towards increasing the depth, liquidity, efficiency, and volumes of funding businesses in Africa.

-Njoki Muthuuri , Co-founder and CEO, Mamlaka Hub & Spoke

We are passionate in our belief that the key to transforming the economic development of African countries is to accelerate the growth of micro and SME businesses. Efficient access to affordable capital has been one of the major challenges. We are excited to work with like minded partners to solve this massive problem with an innovative solution that will unlock new economic opportunities and improve people's lives.

-Maurice Iwunze, CEO of SympliFi

There’s a bottomless arbitrage that we will open up by coming together and interlinking our technologies on an open protocol. We’ve set a massively ambitious goal that each of us, and many others, will play critical roles in realizing as we seek to provide cheap, readily accessible funding for growing businesses across Africa, with UTU providing the critical infrastructure to assess borrower creditworthiness and ensure trust in a trustless system.

-Jason Eisen, Co-Founder and CEO of UTU

Low cost, rapidly accessible working capital is the biggest single success factor to growth on the African Continent.” Ukraine and Russia will still today get lower priced credit than the cost of credit to an average African Business which is totally unreasonable as the risk-based pricing models for Africa are based on outdated beliefs and profit transfer models and don’t work for today’s rapidly evolving business landscape - businesses are getting smarter faster. This relationship with the Africa DeFi Alliance is one we are looking forward to as tapping into the pool of USD$20 billion that is looking for better than US Treasury returns, will make our ability to grow with fairly priced loans limitless. I am really keen on taking this forward with urgency.

-Sachen Chandaria,Group CEO of Orbit Products Africa Ltd

Delivering digitally enabled, accessible, and affordable financing solutions is core to our mission: help merchants grow in the digital economy. We’re thrilled to be at the forefront of leveraging the transformative power of DeFi to fuel this growth, starting with our network of 150K+ merchants and scaling to empower the 100M+ merchants across Sub-Saharan Africa. In joining forces, the Alliance is demonstrating how DeFi will spur economic development and improve livelihoods by unlocking and deploying fit-for-purpose capital, contributing to closing the $330B+ financing gap for SMEs in Africa.

-Tyler Karahalios, Head of Merchant Banking of MarketForce

This partnership is a critical step in our broader strategy of adding value to our ecosystem, and it's part of a suite of creative solutions that will free up liquidity and give our 40K+ driver community access to reasonable operating capital. Similarly, we can use this to provide even better trading terms and more value to the ecosystem, potentially boosting the customer base, customer lifetime value, and order value. I am certain that low cost and unrivaled access to this burgeoning asset class will fuel our long-term expansion and solidify our position as the market leader in B2B transportation.

-Ronald Mahondo, CEO of MaraMoja

About Ape Unit

A team of 30+ designers, developers, and strategists from diverse backgrounds. Focusing on design and development in the blockchain space with the goal of making complex systems easy to use. Always asking: how can decentralization be more impactful?

About BitLipa

BitLipa’s mission is to build technical bridges that narrows the gap and make it easy to on/off-ramp into De-Fi from the comfort of your mobile device.

About Mamlaka Hub & Spoke

MHS is a neo-fintech firm providing trade finance banking services designed to empower the growth of businesses from large to micro in Africa. We run our services on a digital trade platform and leverage on commercial trade data between buyers and suppliers to bridge the trade finance gap and support supply chain ecosystems.

Our key offerings provide :

- Faster liquidity, Transparency, and efficiency in trade transactions

- Speed to Market through an open B2B marketplace

- Track and Trace in a siloed fragmented market: end to end supply chain visibility

- Optimized working capital cycles.

- Enhanced intra-africa trade

MHS trade ecosystem encompasses the entire supply chain from producers, industrial/agro-processors, packaging, Logistics, Warehousing, supermarkets and informal cross border traders.

About SympliFi

SympliFi is a borderless digital lending platform that facilitates access to affordable credit to underserved micro entrepreneurs in developing countries, leveraging the power of community. We are based in the UK with operations in Nigeria, Senegal and Kenya.

About UTU

UTU is building the trust infrastructure of the internet to help users and platforms interact in a safer and more trustworthy way. Starting with Web3 and DeFi apps, we provide AI-powered curation of trust signals from your network at just the right places and times to help you Connect, Send, Swap, Stake, and Borrow with confidence. UTU blockchain protocol transforms the economics of trust. You can Review-to-Earn with UTU Trust Token and monetize that trust you build with $UTU Coin. UTU’s model pays you for building trust online, i.e. for helping others get good outcomes and ensures reputation can’t be bought or manipulated. We believe in decentralization and privacy first. We are proudly based in Nairobi, Kenya with frens all over. Learn more about us on our website, Twitter, Telegram, Discord, LinkedIn, Reddit, YouTube, Facebook and Instagram.